Offshore Company Formation Professionals Offering Custom Support

Offshore Company Formation Professionals Offering Custom Support

Blog Article

Exploring the Refine and Advantages of Offshore Company Formation for Organizations

Offshore Company Formation presents a critical chance for services looking for to increase their reach and maximize monetary performance. By developing entities in desirable territories, business can utilize benefits such as decreased tax liabilities and enhanced privacy. The process includes navigating complicated lawful structures and compliance requirements. Understanding these ins and outs is vital for success. What are the specific benefits that different territories offer, and exactly how can organizations properly manage their offshore operations?

Recognizing Offshore Company Formation

What variables add to the charm of offshore Company Formation? The need for local business owner to maximize worldwide market opportunities plays a substantial function. By establishing an offshore entity, entrepreneurs can access varied markets, enabling expansion beyond domestic boundaries. Additionally, certain jurisdictions supply desirable governing atmospheres and simplified administrative processes, making it less complicated for companies to operate efficiently.Another contributing variable is the capacity for improved personal privacy and privacy. Lots of overseas territories give strict regulations safeguarding the identifications of directors and investors, appealing to those that prioritize discretion. Furthermore, the flexibility in corporate structures is eye-catching, as it allows organizations to customize their operations to certain needs.Finally, the attraction of reduced functional expenses, including tax advantages and reduced compliance concerns, makes overseas Company Formation an attractive approach for many seeking to maximize their company operations in an affordable landscape.

Trick Benefits of Establishing an Offshore Entity

Establishing an overseas entity offers substantial benefits for organizations, specifically in tax obligation optimization and personal privacy security. By strategically positioning a firm in a favorable jurisdiction, organizations can minimize their overall tax obligation responsibilities while preserving privacy regarding their financial tasks. These benefits make overseas Company Formation an enticing choice for numerous business owners seeking to boost their operational performance.

Tax Obligation Optimization Approaches

While many services seek to maximize their profitability, leveraging offshore Company Formation can be a critical strategy to tax obligation optimization. Establishing an overseas entity enables companies to make the most of beneficial tax programs that lots of jurisdictions use, such as reduced or absolutely no company tax rates. This can bring about significant savings, especially for services taken part in global profession or online services. Additionally, offshore business can promote the deferral of taxes on earnings up until they are repatriated, better improving capital. By strategically designating sources and structuring procedures through overseas entities, services can successfully reduce their total tax responsibilities. Ultimately, these methods add to boosted economic efficiency and better competitive benefit in the international market.

Boosted Privacy Security

Just how can organizations protect their sensitive information in a progressively clear globe? Developing an offshore entity offers a practical option for enhancing personal privacy protection. Offshore territories commonly supply rigid confidentiality regulations that protect company info from public analysis. This degree of privacy is specifically appealing for business worried regarding intellectual residential property, economic data, and operational approaches coming to be publicly obtainable. Additionally, offshore structures can reduce the threat of identification burglary and business reconnaissance, as personal and organization details might stay unrevealed. By leveraging these privacy benefits, organizations can operate with greater satisfaction, making certain that their proprietary information is secure. Ultimately, improved privacy security adds not just to functional safety yet also to cultivating an one-upmanship in the market.

Choosing the Right Offshore Jurisdiction

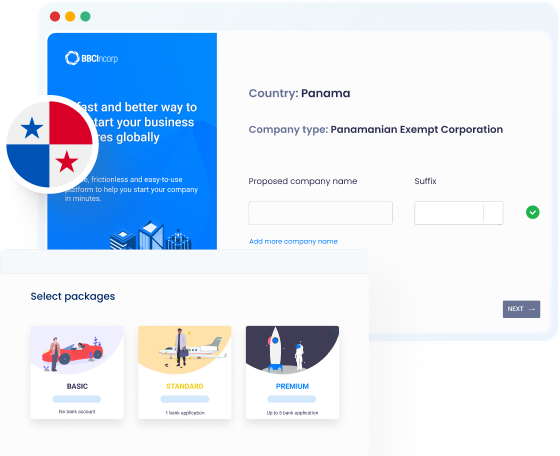

Choosing the appropriate overseas territory is vital for services looking for to maximize their economic and functional strategies. Various elements need to be taken into consideration, consisting of tax regulations, lawful structures, and political security. Popular jurisdictions such as the British Virgin Islands, Cayman Islands, and Panama use desirable tax routines and discretion, making them eye-catching options.Additionally, organizations ought to review the simplicity of conformity, availability to financial solutions, and the reputation of the territory in international markets. Comprehending neighborhood laws and laws is vital, as they can greatly affect service operations and the level of defense paid for to assets.Furthermore, the availability of proficient experts and solution companies can improve the efficiency of overseas operations. Inevitably, mindful research study and consideration of these aspects will certainly lead services to the territory that best lines up with their objectives and long-term vision, guaranteeing a tactical benefit in the affordable global landscape.

Actions to Establish Up an Offshore Company

Establishing an offshore Company entails more info several important actions that can substantially affect its success. One need to pick the territory sensibly to straighten with business goals and lawful demands - offshore company formation. Following this, preparing the necessary documentation and opening up a checking account are essential activities to guarantee smooth procedures

Pick Jurisdiction Sensibly

Prepare Necessary Documentation

After identifying an ideal territory, the next step in establishing an overseas Company entails preparing the required documentation. This procedure normally calls for several crucial papers, including the Company's memorandum and articles of association, which describe the Company's purpose and interior laws. Furthermore, evidence of identity and address for all investors and supervisors must be gathered, frequently demanding notarized duplicates of passports and utility costs - offshore company formation. Some jurisdictions might also require a company plan or a description of desired tasks. It's important for local business owner to guarantee that all documents abides by local laws, as inaccurate or incomplete submissions can lead to hold-ups or rejections in the application process. Proper company of these documents facilitates a smoother configuration experience

Open Checking Account

Opening a savings account is a necessary step in the offshore Company Formation procedure. This account offers as the financial center for the organization, permitting for deals, financial investments, and operational expenditures to be taken care of effectively. To open an overseas savings account, one should commonly give identification records, evidence of address, and the Company's enrollment details. Many financial institutions call for a minimal down payment and might perform due persistance to guarantee compliance with worldwide laws. Selecting a financial institution that focuses on overseas services can enhance the process, using customized remedies to satisfy company demands. Furthermore, understanding the financial institution's charge structure and services is essential for optimizing financial monitoring in an offshore context.

Governing and lawful Considerations

While the appeal of overseas Company Formation typically stems from potential tax benefits and asset security, it is critical for service owners to browse the complex landscape of lawful and regulative considerations. Different territories impose varying regulations pertaining to Company compliance, coverage, and enrollment. Recognizing local regulations is very important to guarantee adherence and prevent possible penalties.Furthermore, international regulations, such as anti-money laundering (AML) and recognize your consumer (KYC) needs, may use depending upon the nature of the business activities. Failure to abide by these policies can bring about legal difficulties and reputational damage.Additionally, tax treaties in between countries might influence the tax responsibilities of offshore entities, making it vital for entrepreneur to speak with lawful and monetary professionals. In general, an extensive understanding of these legal frameworks is crucial for companies looking for to establish a successful overseas visibility while reducing dangers.

Techniques for Reliable Offshore Monitoring

Maneuvering the intricacies of overseas Company Formation needs not just an understanding of regulatory and legal frameworks but additionally effective monitoring approaches to ensure lasting success. Key methods include developing robust communication channels amongst stakeholders, making certain openness in operations, and implementing strong interior controls to mitigate dangers. On a regular basis reviewing efficiency metrics assists identify locations for renovation and promotes accountability.Additionally, leveraging technology can simplify procedures, improve data safety, and enable real-time decision-making. Cultivating a culturally mindful and skilled management group is crucial, as they can navigate the subtleties of operating throughout various territories. Developing calculated partnerships with neighborhood advisors can give very useful insights into market dynamics and regulative modifications. Establishing a clear vision and mission for the offshore entity can motivate and align efforts commitment among team participants, eventually driving sustained growth and success in the affordable worldwide landscape.

Usual Misconceptions Concerning Offshore Business

What gas the misunderstandings surrounding offshore business? A combination of media representation, lack of understanding, and historical organizations with tax evasion adds substantially. Numerous regard offshore companies only as lorries for immoral tasks, overlooking their reputable uses, such as property security and worldwide market access. Another common myth is that just rich people can gain from offshore developments. In truth, small and medium-sized enterprises likewise leverage these structures for various advantages, consisting of reduced operational expenses and enhanced personal privacy. In addition, some believe that all offshore jurisdictions are tax obligation havens, overlooking the variety of laws and conformity needs across various regions. Misunderstandings about the complexity of handling overseas entities even more bolster these misconceptions. By dealing with these misunderstandings, companies can better appreciate the legitimate possibilities that offshore Company Formation provides, enabling them to make educated choices for development and development.

Often Asked Concerns

Can Individuals Form Offshore Companies Without Business Experience?

People can certainly develop overseas firms without prior service experience. offshore company formation. Lots of territories offer accessible sources and assistance services, making it possible for newbies to browse the procedure, comprehend guidelines, and handle their brand-new ventures effectively

What Is the Minimum Financial Investment Required for Offshore Company Configuration?

The minimum financial investment required for offshore Company setup varies considerably by territory, normally ranging from a couple of hundred to several thousand dollars. Variables influencing prices consist of enrollment fees, lawful solutions, and essential conformity responsibilities.

Are Offshore Business Based On International Tax Obligations?

Offshore firms might not be subject to international taxes, relying on territory and details tax obligation regulations. They need to conform with regional policies and might face taxation in their nation of enrollment or operation.

Can Offshore Business Open Financial Institution Accounts Quickly?

Offshore companies often locate it reasonably straightforward to open up savings account, given they satisfy certain documentation and conformity needs. Factors like jurisdiction, financial institution plans, and the Company's company activity substantially affect the convenience of this process.

For how long Does It Require To Register an Offshore Company?

The duration for signing up an offshore Company typically differs by jurisdiction, varying from a few days to several weeks. Elements influencing the timeline include documents demands, regulatory approvals, and the performance of local authorities. Offshore Company Formation offers a tactical opportunity for businesses looking for to increase their reach and maximize economic performance. While several organizations seek to optimize their profitability, leveraging offshore Company Formation can be a strategic method to tax obligation optimization. Developing an overseas entity allows business to take benefit of positive tax programs that several jurisdictions provide, such as reduced or absolutely no corporate tax obligation rates. While the allure of overseas Company Formation frequently stems from potential tax advantages and property protection, it is imperative for company owners to browse the complicated landscape of regulatory and legal considerations. People can undoubtedly create offshore companies without prior company experience.

Report this page